The Reality of Greenwashing

What does Greenwashing look like in reality?

To better understand how greenwashing strategies are implemented in real life, you can probably think of many examples listed in the “The seven sins of greenwashing” initially proposed by the environmental marketing firm TerraChoice. These sins help discourage companies from applying these green marketing strategies, by giving consumers the information they need when making purchase decisions. However, there are also more specific lists of sins, defined through looking at the gas and oil industry and their communication on hydraulic fracking (Scanlan, 2017).

- The sin of false hopes: a claim that reinforces a false hope (or reduced negative impact) on the environment. In the case of hydraulic fracking, which has an enormously negative impact on the environment, this happens a lot. Critics argue that ecological modernisation is not possible and believing otherwise is harmful to the environment.

- The sin of fear mongering: claims that fabricate insecurity related to not “buying in” on an organisational practice, like hydraulic fracking. Scanlan (2017, p. 16) explains that “shifting the scale of fear and seizing opportunities from instability and uncertainty borne out of wars in Afghanistan and Iraq, the global war on terror, and volatile fuel costs, alter the public perception of risk”.

- The sin of broken promises: making promises that fracking will lift up poor, rural communities with income from mineral rights and economic development, but when evidence shows the contrary. Communities are left with irreversible impacts (Siegel, 2014).

- The sin of injustice: observed environmental communication does not speak directly to communities most affected by fracking, it focuses on a segment of the population that benefits from fracking but does not not suffer its consequences. This is often can be seen with greenwashing strategies.

- The sin of hazardous consequences: greenwashing hides the reality of inequality and distracts the public from dangers. Scanlan 2020 includes another sin regarding harm done from hazardous consequences.

- The sin of profits over people and the environment: Scanlan (2020) describes as potentially the greatest greenwashing sin of all.

In the article “Fuzzy reporting as a way for a company to greenwash: perspectives from the Colombian reality” by Contreras-Pacheco and Claasen (2017), five further firm–level greenwashing strategies were identified. Compared to the previous six bullet points and the sins of greenwashing, these are more commonly used further up the corporate chain.

- Dirty business: working with a clearly unsustainable business model or industry but promoting sustainable practices or products that are not representative either of the business or the society.

- Ad bluster: using aggressive advertising to redirect attention away from sustainability issues, and exaggerate achievements or alternative programmes that are not connected to solving the underlying issues

- Political spin: using the influence of large corporations to sway governments or politicians to obtain benefits that will harm the environment. Typically, you see reduced reporting requirements, large subsidies or lower regulatory pressure to reduce pollution.

- It’s the law, stupid: proclaiming sustainability accomplishments or commitments that are already required by existing laws or regulations. Examples here are recycling requirements, waste reduction and emission reductions.

- Fuzzy reporting: taking advantage of sustainability reports and their one-way communication channels; to twist the truth or project a positive image of CSR corporate practices. In contrast to regular annual reports, CSR reports have lower regulatory requirements and guidelines so that it is easier for corporations to employ this greenwashing strategy.

We’ve talked at length about how companies can deliberately use greenwashing strategies. However, it’s also common for companies to use greenwashing unknowingly. The next section will explore this problem, combining findings from asset management with known corporate problems.

What is accidental greenwashing?

Demand for sustainable investments is growing rapidly and inexorably, and corporate greenwashing is presenting asset managers in the financial industry with critical challenges. Greenwashing by an asset manager is a specific focus for regulators, given that environmentally focused funds continue to dominate the ESG scene. What we can observe is a heavy emphasis on better disclosure and increased transparency from investment vehicles around the globe. Yet, accidental greenwashing is a growing concern for asset managers as they face a dizzying array of data sets, irregular reporting standards and non-transparent corporate practices. While asset managers are figuring out how to meet stakeholder expectations and comply with new regulatory

requirements, the risk of being accused of greenwashing rises when they cannot provide sufficient support for claims around the ESG attributes of their funds.

However, not only asset managers can fall into the trap of accidental greenwashing. Especially startups and small /and medium/sized enterprises (SME) struggle with avoiding greenwashing while still being truthful and about their sustainable practices. Depending on the industry, up to 98% of the ecological footprint comes from the supply chain instead of the initial production of the product. If a supplier engages in greenwashing, knowingly or unknowingly, this has a domino effect that jeopardises the ESG goals of all subsequent companies in the supply chain. So how can startups and SMEs mitigate the risk of accidental greenwashing?

It all starts with the right data to ensure transparent supply chain management. A well-founded database ensures that ESG communications withstand due diligence and that sustainability communication does not become a danger. It also guarantees compliance with regulations and the transparency gained allows companies to further improve on the reduction of emissions and the efficiency of their supply chain. The first step is product compliance and a reliable system for collecting product data. This can serve as a basis for due diligence to gain more in-depth insight into the supply chain. The future for more transparent supply chains is looking good, with innovative blockchain and Web 3.0 technologies making the overall processes more traceable and transparent. But until then, companies must rely on primary data sources and critically observe the ESG scores of their suppliers. Frameworks like the Lifecycle Assessment can help companies to holistically track and analyse their products and services.

How can you identify and mitigate corporate greenwashing?

As we have now talked a lot about corporate greenwashing strategies and their implementation, it is now time to focus on the consumers. How can the average person avoid greenwashing while shopping and consuming? Although it doesn’t always feel like it, as consumers we have tremendous power. The purchases that we make every day can change the way manufacturers produce and sell items, which is why it is more important than ever to have the knowledge and the tools to identify greenwashing.

At the heart of most greenwashing and false marketing claims are two common corporate strategies. The first is complete company rebranding. In times when sustainability has become even the more important to consumers, companies often rebrand or repackage their products to look more “green.” This is usually done by changing logos, colours, and slogans with environmentally friendly buzzwords and imagery. Look for natural colours, animals and plants and certain phrases, including terms like “all-natural,” “eco-friendly,” and even “farm fresh.” The second reason for companies to use greenwashing strategies are claims of legitimacy. Greenwashing can easily magnify a narrow set of a product or service’s attributes that appear eco-friendly. For example, a minimal amount of a product’s packaging might be biodegradable, compostable, or made from recycled content but the majority of the product or company’s practices are harmful to the environment.

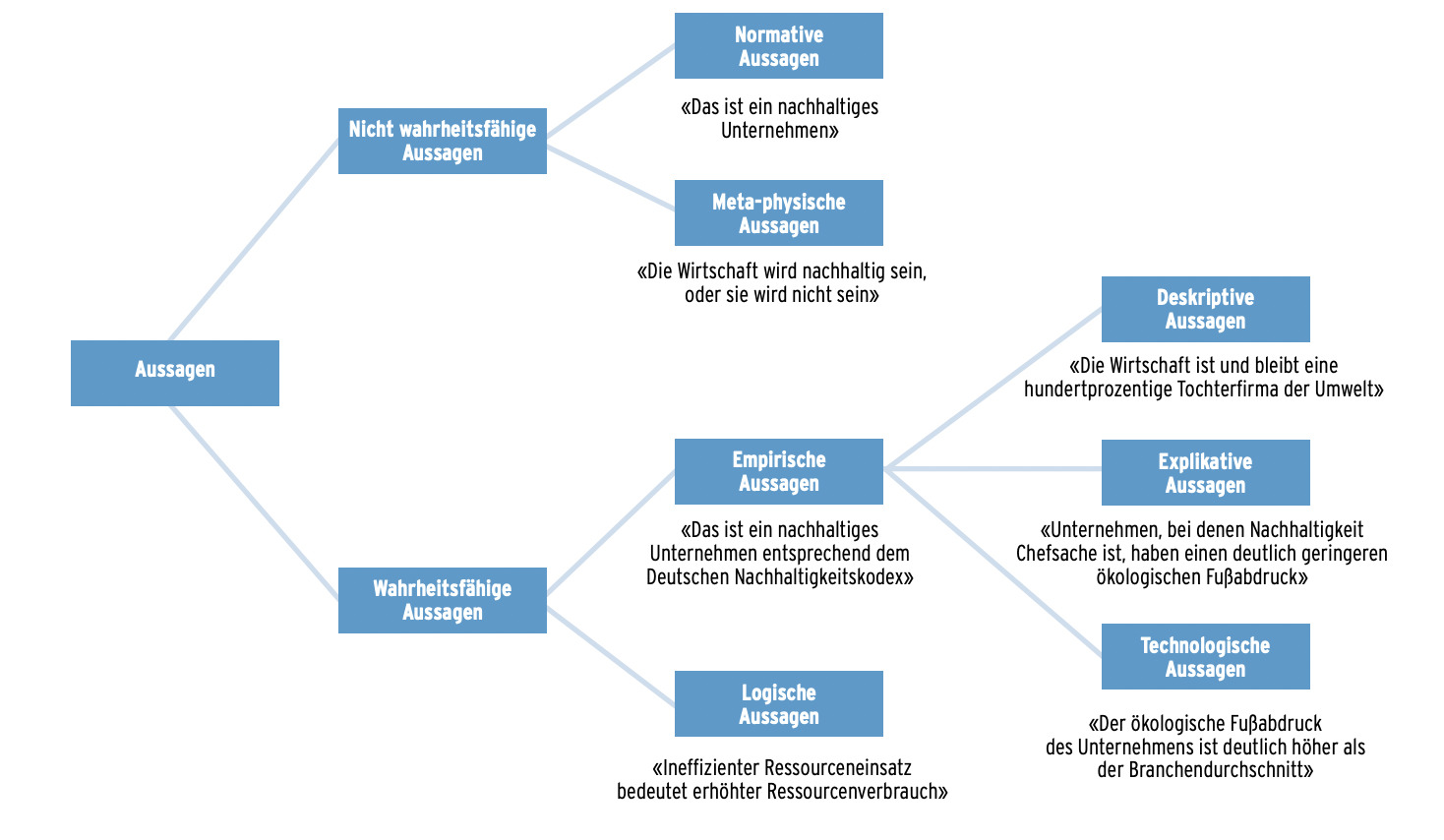

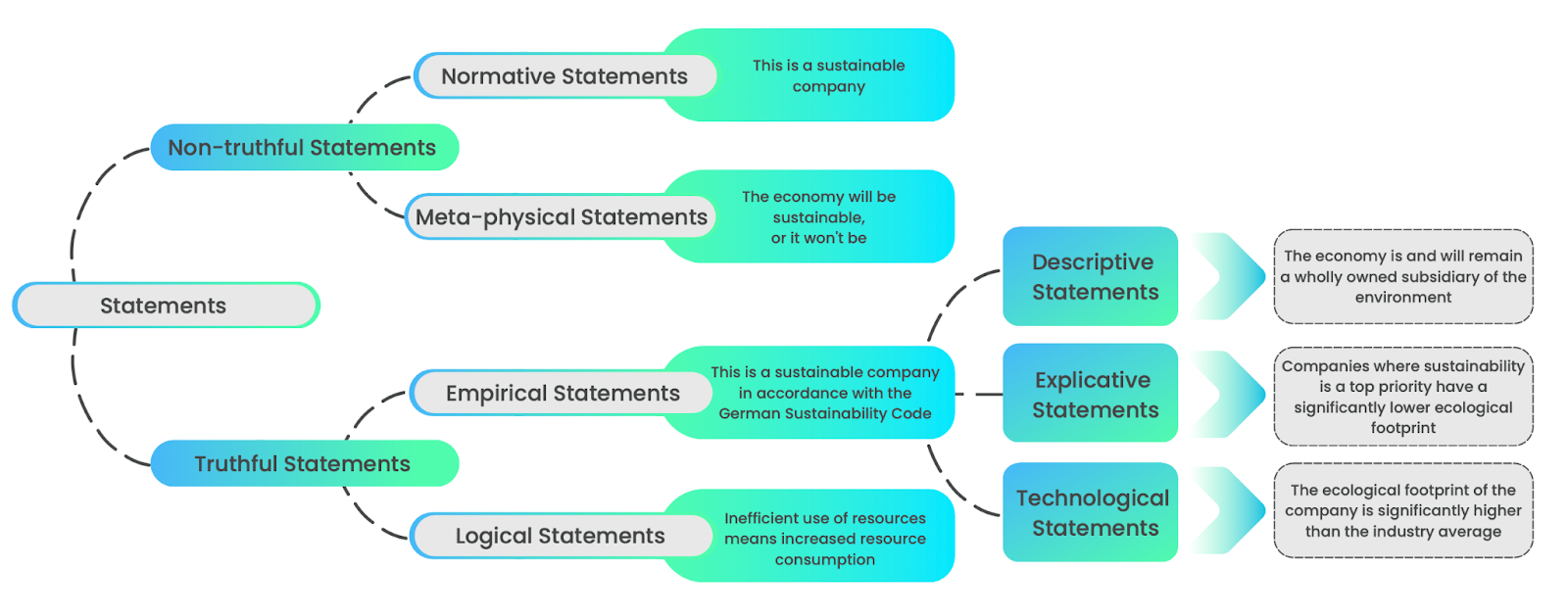

With these two strategies in mind, it is critical to check for the trustworthiness and reliability of claims made by a company or a product. The visual below will help you to better understand which claims are used in greenwashing and which are used to promote real sustainable impact.

In addition to this graphic, we will some further tactics that you can use to avoid greenwashing, be more critical of corporate sustainability claims and not fall into the trap of false advertisement.

- Look for well-known certifications.

A company can put “natural and organic” on their labels, but if it doesn’t have a certification label, it is most likely NOT organic. Still, we all know that certifications aren’t perfect, but they can act as a step towards more responsible consumption. - Look out for “aesthetic” green packaging

A prominent example of a company that utilises greenwashing techniques is Fiji Water – their commercials and product design features a natural landscape and makes claims like “Fiji Water is nature’s gift to us,” “bottled at the source,” and “untouched by man.” They cannot substantiate these claims. - Beware of the most typical greenwashing words

We already listed some of them above, but pay attention when companies use the words like eco-friendly, green, all-natural, earth-friendly, non-toxic, plant-based, plant-derived, pure, raw, healthy, or organic without stating numbers or certifications to support these claims. - The lesser of two evils

A company might claim to be “greener” than its competitors, but if the whole industry itself is unsustainable, does this make a difference? (i.e., plastic bags and most single-use items). - Buy less

May seem simple, but the biggest impact we as consumers can have is by buying less stuff. In reality, reducing the amount you consume and reusing what you already have is the best way to ensure that you are being more sustainable.

Sources

Berrone, P., Fosfuri, A., & Gelabert, L. (2015). Does Greenwashing Pay Off? Understanding the Relationship Between Environmental Actions and Environmental Legitimacy. Journal of Business Ethics, 144(2), 363–379. https://doi.org/10.1007/s10551-015-2816-9

Bradshaw, C. J. A., Ehrlich, P. R., Beattie, A., Ceballos, G., Crist, E., Diamond, J., Dirzo, R., Ehrlich, A. H., Harte, J., Harte, M. E., Pyke, G., Raven, P. H., Ripple, W. J., Saltré, F., Turnbull, C., Wackernagel, M., & Blumstein, D. T. (2021). Underestimating the Challenges of Avoiding a Ghastly Future. Frontiers in Conservation Science, 1. https://doi.org/10.3389/fcosc.2020.615419

Chen, Y., & Chang, C. (2013). Towards green trust. Management Decision, 51(1), 63–82. https://doi.org/10.1108/00251741311291319

de Freitas Netto, S. V., Sobral, M. F. F., Ribeiro, A. R. B., & Soares, G. R. D. L. (2020). Concepts and forms of greenwashing: a systematic review. Environmental Sciences Europe, 32(1). https://doi.org/10.1186/s12302-020-0300-3

Delmas, M. A., & Burbano, V. C. (2011). The Drivers of Greenwashing. California Management Review, 54(1), 64–87. https://doi.org/10.1525/cmr.2011.54.1.64

Dowling, J., & Pfeffer, J. (1975). Organizational Legitimacy: Social Values and Organizational Behavior. The Pacific Sociological Review, 18(1), 122–136. https://doi.org/10.2307/1388226

E. Contreras-Pacheco, O., & Claasen, C. (2017). Fuzzy reporting as a way for a company to greenwash: perspectives from the Colombian reality. Problems and Perspectives in Management, 15(2), 525–535. https://doi.org/10.21511/ppm.15(si).2017.06

Hartmann, P., & Apaolaza-Ibáñez, V. (2009). Green advertising revisited. International Journal of Advertising, 28(4), 715–739. https://doi.org/10.2501/s0265048709200837

Lamin, A., & Zaheer, S. (2012). Wall Street vs. Main Street: Firm Strategies for Defending Legitimacy and Their Impact on Different Stakeholders. Organization Science, 23(1), 47–66. https://doi.org/10.1287/orsc.1100.0631

Mangini, F., Chafik, L., Madonna, E., Li, C., Bertino, L., & Nilsen, J. E. I. (2021). The relationship between the eddy-driven jet stream and northern European sea level variability. Tellus A: Dynamic Meteorology and Oceanography, 73(1), 1886419. https://doi.org/10.1080/16000870.2021.1886419

Pearson, J. (2010). Turning Point. Are We Doing the Right Thing? Leadership and Prioritisation for Public Benefit. Journal of Corporate Citizenship, 2010(37), 37–40. https://doi.org/10.9774/gleaf.4700.2010.sp.00006

Scanlan, S. J. (2017). Framing fracking: scale-shifting and greenwashing risk in the oil and gas industry. Local Environment, 22(11), 1311–1337. https://doi.org/10.1080/13549839.2017.1345877

Shrivastava, P., & Hart, S. (1995). Creating sustainable corporations. Business Strategy and the Environment, 4(3), 154–165. https://doi.org/10.1002/bse.3280040307Siegel, F. (2014, June 1). The poverty of environmentalism. Gale Academy. Retrieved September 1, 2022, from https://go.gale.com/ps/i.do?id=GALE%7CA372450450&sid=googleScholar&v=2.1&it=r&linkaccess=abs&issn=01472011&p=AONE&sw=w&userGroupName=anon%7Edfbb0348